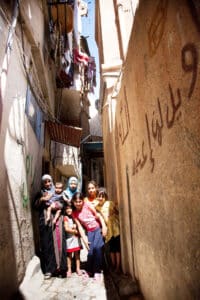

Bank in Beirut in 2021 (source: Wikimedia Commons)

Last week, Lebanon was shaken by a series of “bank robberies”, in which “robbers” forcibly demanded to retrieve money from their own bank accounts. The country has been plagued by a worsening economic crisis since 2019, devaluating the Lebanese pound and evaporating savings-accounts. Banks hold extremely unfavourable exchange rates. As a result, “robbers” demanding to retrieve their own savings appear to become a trend.

Forced to “take matters into their own hands”

On Wednesday September 14, an armed man attempted to retrieve his savings in a bank in the city of Aley. On that same day, a woman named Sali Hafiz, along with other activists, stormed a bank in Beirut, demanding money from her savings account. She claimed she needed the money to fund hospital treatment for her ill sister. Hafiz managed to retrieve 13.000$ out of a total of 20.000$. The bank has not pressed any charges yet.

Both “robbers” were part of a movement named Depositors’ Outcry, that has declared “war” on the banks. The movement’s founder, Alaa Khorchid, argued that the economic crisis has forced people to “take matters into their own hands”.

Robin Hood status

The following Friday, at least five “bank heists” took place, both in Beirut and the south of the country. One of the “robbers”, a merchant identified as Abed Soubra, was cheered on by a large crowd. He demanded to retrieve 275.000$ from his account, that he needed to repay his debts.

The first-known case of someone forcibly demanding their savings was reported in January of this year. A man held dozens of people hostage in a bank in eastern Lebanon. Last August, an armed man entered a bank in Beirut, holding employees and customers hostage for hours. He had been told he could not withdraw 200.000$ from his account, that he needed to pay for his ill father’s treatment.

Several of the “robbers”, all of whom have no criminal record, have attained a sort of Robin Hood status. They enjoy the support of a significant share of the Lebanese population.

In response to the series of “robberies” last week, the Lebanese Banking Association announced that the banks would close for three days, starting on Monday September 19. It claimed that banks feared for the safety of their staff.

Disadvantageous exchange rates

The Lebanese economic crisis dates to the accumulation of high debts since the end of the civil war in 1990. In 2016, banks offered high interest rates for new deposits of dollars and Lebanese pounds. This caused a climb of foreign reserves but was also associated with increasing liabilities. Then, many foreign donors backed out, blaming sectarian conflicts, a lack of governance and a failure to deliver reforms. In March 2020, Lebanon defaulted on its foreign debts. The country lost the dollars it relied on an many banks closed their doors.

Since the onset of the economic crisis, the Lebanese pound has lost 95% of its value. Lebanese banks request that money is exchanged into Lebanese pounds, before it can be withdrawn. As a result, banks hold absurdly disadvantageous exchange rates. For example, if someone wants to withdraw 700$ in savings, they only receive 200$. More than three quarters of the Lebanese population is now living below poverty, according to the United Nations.

Lack of political decisiveness

The international community has repeatedly pushed for economic reforms, as a prerequisite for an IMF bailout. It has urged the Lebanese government to put an end to wasteful spending, widespread corruption and to reshuffle their energy sector. However, political decisiveness seems far-off. A meeting of the Lebanese parliament to discuss this year’s budget was cancelled, because the quorum was not reached. Too many MPs had walked off out of frustrations with the “chaotic discussions”.

Sources: Al Jazeera 1, Al Jazeera 2, Al Jazeera 3, Al Jazeera 4, De Volkskrant

Photo: Wikimedia Commons